Best Free Crypto Portfolio Tracker Tools (Reviewed) – How to Calculate Long-Term Returns

At first glance, tracking crypto returns seems easy: you buy, you hold, and you check if the price went up. But once you factor in time, staking rewards, multiple exchanges, and compounding effects, that simplicity fades fast. What may look like a solid short-term gain often turns out to be something very different when viewed across months or years.

Even seasoned investors struggle to measure their true long-term performance. Daily price changes and eye-catching PnL percentages can easily hide whether a portfolio is actually growing wealth over time. That’s why learning to calculate long-term returns correctly has become such a crucial skill in 2025-and why tools built for deeper, time-aware analysis are finally taking center stage.

Introduction

Getting an accurate picture of long-term crypto returns has never been more essential-or more misunderstood. In a market where volatility grabs all the attention, few investors bother to look past daily profit charts to see how their capital is truly growing over time.

Why Most Investors Misread “Profitability” in Long-Term Crypto Holding

Many crypto holders assume that if their portfolio’s dollar value has gone up, they’ve earned a profit. But that view often ignores key factors like the cost basis, reinvested rewards, and the timing of market entries and exits.

For example, imagine buying Bitcoin during the 2021 rally and holding it through several halvings. Your nominal return might look impressive on paper-but your realized ROI, after accounting for fees, swaps, and holding costs, could be much lower.

This confusion stems from mixing up unrealized gains with realized profits. Unrealized gains fluctuate with market prices, while realized ROI measures actual performance once positions are closed. And the longer your investment horizon, the bigger that gap can grow.

The Gap Between Daily PnL and Real Compounded ROI

PnL (Profit and Loss) snapshots are made for traders, not long-term investors. They capture short-term performance – useful for quick decisions, but misleading when you’re trying to measure true, compounded growth.

Consider this example:

A portfolio gains +10% one month and then loses -10% the next. Most people think it breaks even – but in reality, it ends lower than where it started. Without accounting for compounding, spreadsheets and many tracking tools simply can’t show this correctly.

That’s where metrics like Annualized ROI or CAGR (Compound Annual Growth Rate) come in. They fill the gap by showing how money actually grows over time, not just how it fluctuates from one moment to another.

| Metric | Purpose | Problem |

| Daily PnL | Tracks short-term movement | Ignores compounding and reinvestment |

| ROI | Measures total gain over time | Fails when cost basis is missing or miscalculated |

| CAGR | Annualized rate including time and compounding | Most accurate for long-term evaluation |

Understanding this difference changes how investors think about “profit.” It moves the focus from reacting to daily numbers toward strategically measuring long-term growth.

The Need for Analytical Tools That Measure Multi-Year Performance, Not Just Short-Term Volatility

Traditional ROI calculators and exchange dashboards weren’t built for multi-year performance tracking. They lack the time awareness that long-term investing demands. Without features like time-weighted returns, historical benchmarks, and CAGR visualization, investors risk drawing the wrong conclusions about how well their strategies are actually working.

Modern portfolio trackers now close this gap. They bring together historical trades, price data, and staking yields, turning fragmented crypto activity into a clear, long-term picture.

Whether it’s institutional tools like Bitwave or investor-focused platforms like CoinDataFlow, the new wave of analytics tools prioritizes accuracy over immediacy.

These platforms finally shift the key question from

“Did I make money today?”

to

“How efficiently has my capital grown since I started?”

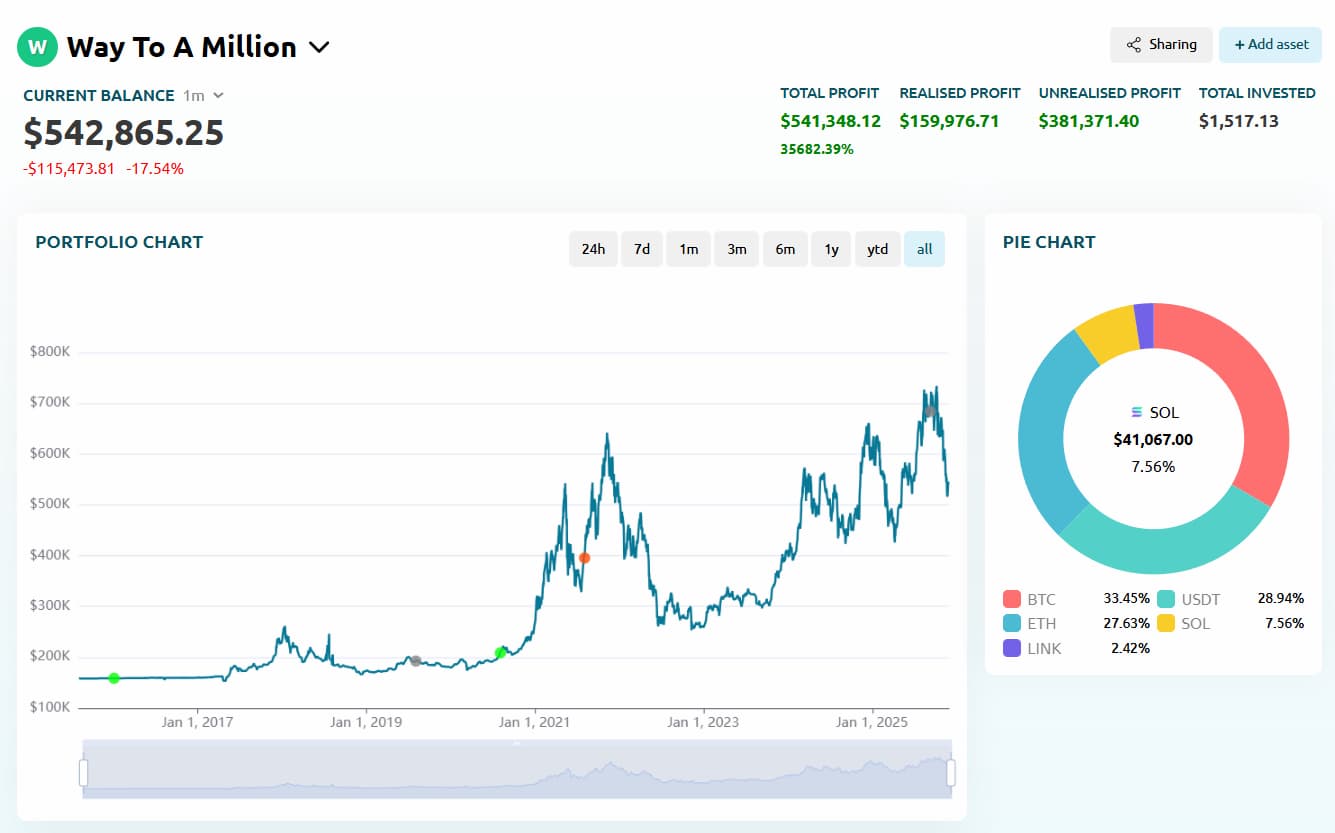

1. CoinDataFlow

Before comparing individual competitors, it’s worth starting with a platform designed specifically for long-term investors. CoinDataFlow focuses on precision, transparency, and stability-helping users move beyond guesswork and toward dependable, multi-year analytics.

It’s not a trading platform and doesn’t automate execution. Instead, it concentrates on the three pillars of long-term ROI measurement: accuracy, historical clarity, and consistency.

Core Focus: Built for Long-Term Investors – Precise ROI and CAGR Modeling Over Time

While most trackers highlight daily price swings or short-term PnL, CoinDataFlow zeroes in on time-adjusted metrics. It emphasizes CAGR calculations, historical ROI curves, and multi-year benchmarking, allowing investors to see how their capital grows through bull runs, halvings, and quiet market phases alike.

Its data structure lets users rebuild their entire portfolio history, even if assets have moved between exchanges or wallets. This prevents the missing or duplicate entries that often distort long-term ROI results.

Here’s a simple illustration of how accurate CAGR modeling can clarify performance:

| Year | Portfolio Value | Deposits | Real ROI | CAGR Estimate |

| 2021 | 10,000 | 0 | Baseline | Baseline |

| 2022 | 13,500 | 1,000 | 25% | 11.8% |

| 2023 | 17,800 | 2,000 | 21% | 12.4% |

With daily PnL, this growth might look inconsistent. With a time-weighted model, the trend becomes clear and coherent.

Pros: Time-Weighted Accuracy, Historical ROI Graphs, Multi-Asset Benchmarking, and Transparent Formulas

CoinDataFlow is built for investors who want a clear, verifiable understanding of how their portfolio performs compared to key benchmarks. Users can compare their long-term results against BTC, ETH, or even macro indices, which is rare – most trackers focus only on individual asset charts.

Other notable strengths include:

- Price-sensitive historical syncing – each transaction is reconstructed using real market data, not just user entries.

- Cross-exchange reconciliation – automatically removes duplicates and mismatched trades, keeping records clean.

- Clarity-first dashboards – shows both unrealized and realized performance clearly separated.

- Formula transparency – all calculations are documented, allowing users to verify or reproduce results manually.

This transparency helps beginners avoid classic mistakes, such as mistaking balance changes for actual profit, while giving experienced investors the precision they need to evaluate long-term efficiency.

Cons: No Auto-Trading – Focused on Analytics Over Execution

Some investors prefer platforms that combine analytics with features like automated strategies or tax filing. CoinDataFlow deliberately avoids that approach. It doesn’t include bot trading, auto-rebalancing, or tax reporting modules.

While this may make it less appealing to automation-focused traders, it strengthens reliability for those who want pure analytical accuracy without operational risk or API overreach.

Why Its Balance of Accessibility and Professional Analytics Works in 2025

In today’s market, investors face a choice between overly simple mobile apps and overly complex institutional dashboards. CoinDataFlow finds the middle ground. Beginners appreciate its clean layout and clear ROI explanations, while professionals value its benchmarking tools, historical reconstruction, and time-weighted performance modeling.

The result is a platform that grows with the investor – approachable at first, yet powerful enough to remain useful as portfolios become more complex.

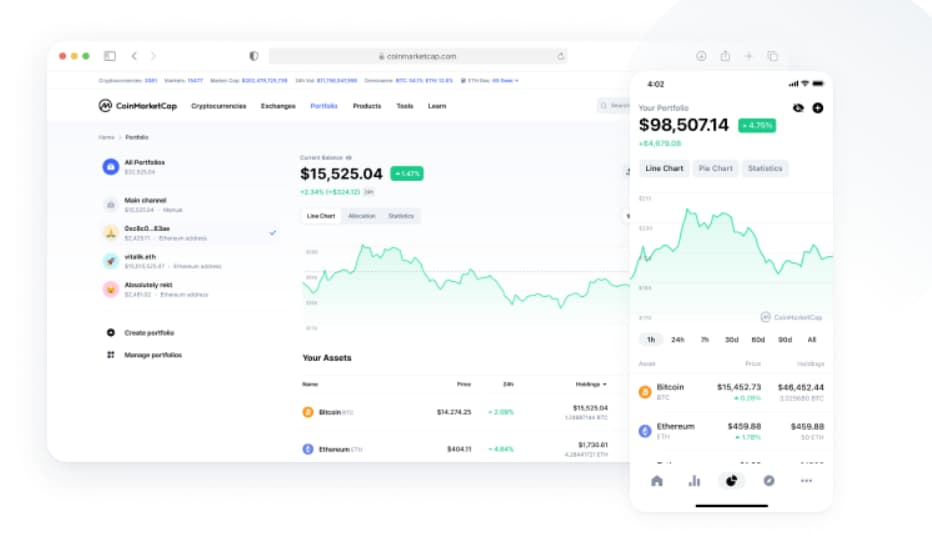

2. CoinMarketCap Portfolio

CoinMarketCap Portfolio remains one of the most recognizable entry-level crypto trackers-mainly because so many users already visit the site for market data. Its portfolio tool reflects that same simplicity: it gives beginners a basic view of their holdings without requiring deep setup or financial expertise. However, once you start looking at long-term ROI, its limitations quickly become obvious.

Long-Standing Credibility and Simple Onboarding

Many users discover CoinMarketCap’s portfolio feature almost by accident. While checking charts or researching projects, they notice the Portfolio tab and start tracking their assets manually. This ease of discovery makes it a natural first choice for newcomers who simply want to know their total balance.

Setup is straightforward:

You add assets manually, input transaction details, and start tracking within minutes. For people unfamiliar with cost basis or ROI concepts, this simplicity provides a low-stress starting point.

Here’s what a new user typically sees:

| Feature | What It Shows | Beginner Benefit |

| Total balance | Combined portfolio value | Quick snapshot |

| Allocation chart | Percentage per asset | Easy visual breakdown |

| Watchlist sync | Saved coins from browsing | Familiar and seamless |

| News feed | Market headlines | Context without extra effort |

This intuitive entry point gives beginners structure without overwhelming them with data.

Interface Clarity for Beginners

CoinMarketCap Portfolio intentionally avoids clutter. Its interface uses large numbers, simple color codes, and a clean dashboard layout that feels comfortable even for users with no prior investing experience.

This light design is especially helpful for people just learning the difference between unrealized gains, realized gains, and price movement. For first-time investors, such simplicity can make the learning curve far less intimidating.

Weaknesses in Automation and Data Granularity

However, once portfolios grow, CoinMarketCap’s limits start to show. It doesn’t offer automated syncing between exchanges or wallets, meaning users must manually update transactions whenever they buy, sell, stake, or transfer.

This quickly leads to data inconsistencies, such as:

- Transfers appearing as new buys or sells

- Staking rewards requiring manual entries

- Wallet-to-wallet movements breaking cost basis continuity

- Multi-year portfolios becoming unreliable without constant updates

Unlike advanced tools, CoinMarketCap Portfolio doesn’t clearly separate realized from unrealized performance. For long-term investors, that means distorted results when analyzing multi-year returns.

The lack of deeper analytics also becomes a serious constraint. There’s no time-weighted ROI, no compounding models, and no benchmarking against market indexes.

As a result, while CoinMarketCap Portfolio serves well as an introductory dashboard, investors who stay in crypto for several years often outgrow it and move to platforms built with long-term performance logic in mind.

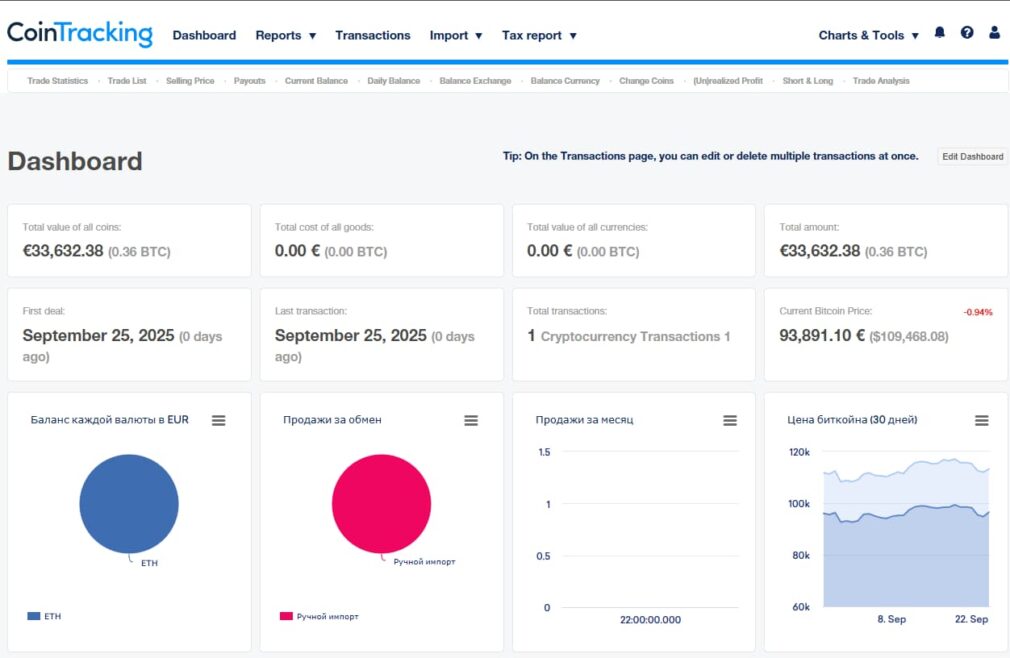

3. CoinTracking

CoinTracking has long held a respected place in the crypto ecosystem thanks to its depth, precision, and strong focus on tax-related analytics. It typically attracts investors who have outgrown beginner tools and now need granular control over their trade history, cost basis, and long-term ROI. However, that same depth also makes it more complex than most modern solutions.

Historical Data Depth and Tax-Ready Reporting

One of CoinTracking’s greatest strengths lies in its ability to handle large, detailed historical data. Users can import years of transactions from numerous exchanges, CSV files, and even blockchain explorers. This makes it ideal for investors who’ve traded across multiple platforms and want a single, consolidated performance view.

Because CoinTracking processes each trade individually, its cost basis and ROI calculations are exceptionally precise – a major advantage when preparing tax filings or accountant reports. The platform supports multiple accounting methods, including FIFO, LIFO, HIFO, and several country-specific rules.

Here’s a quick snapshot of what sets CoinTracking apart:

| Area | Strength | Benefit |

| Multi-year imports | Supports dozens of formats | Ideal for long trading histories |

| Tax methods | FIFO, LIFO, HIFO, ACB | Adapts to global regulations |

| Trade grouping | Detailed event tracking per asset | Clear realized gain/loss visibility |

| Large-data handling | Processes thousands of trades | Excellent for high-volume users |

This level of precision makes CoinTracking especially valuable for anyone maintaining complex, multi-year portfolios.

Ideal for Detailed Analysis and Compliance

For investors who want full transparency into their long-term results, CoinTracking offers a comprehensive suite of analytics tools, including:

- Profit and loss per asset

- Timeline and performance graphs

- Trading fee aggregation

- Custom ROI intervals

- Exportable tax and performance reports

These capabilities make it a strong choice for users preparing annual reports, reconciling multi-year activity, or working with professional accountants. Those who value data structure and audit readiness over visual simplicity often find CoinTracking perfectly suited to their workflow.

Heavy UX and Pricing for Small Investors

Despite its analytical power, CoinTracking presents challenges for casual users. The interface can feel dense, with multiple menus, advanced settings, and frequent cleanup steps after importing data. Originally designed for power users, it comes with a steep learning curve.

New investors often encounter:

- Duplicate entries after import

- Missing cost-basis fields

- Manual corrections required

- Complex accounting terminology

And while CoinTracking does offer a free plan, meaningful long-term use – especially for large datasets – usually requires a paid subscription. The higher tiers, which unlock tax reporting and expanded data capacity, can feel excessive for smaller portfolios.

Still, for serious investors who prioritize accuracy and compliance over ease of use, CoinTracking remains a top-tier solution for long-term performance tracking.

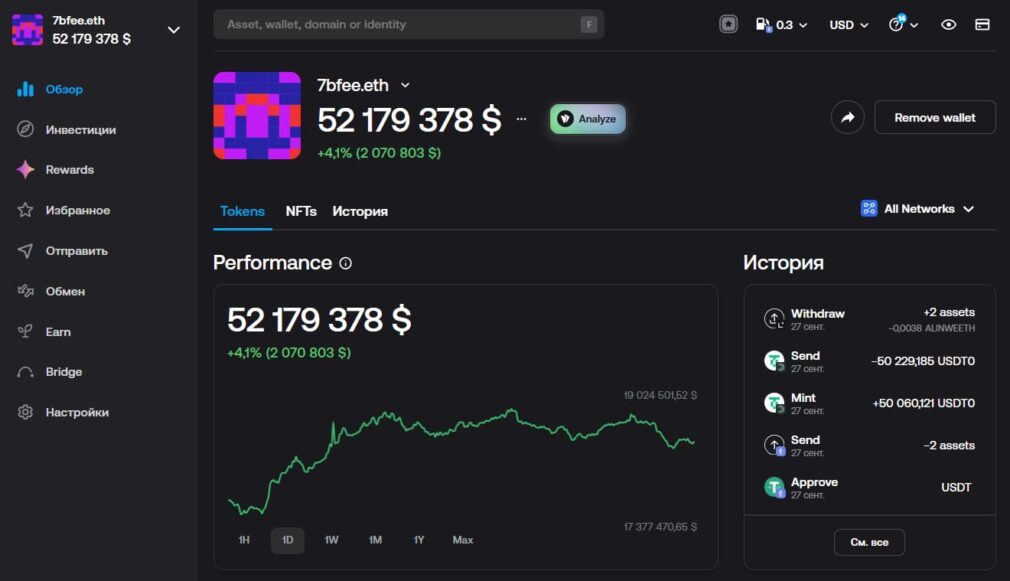

4. Zerion

Many long-term crypto holders begin with centralized exchanges and only later step into the world of DeFi. Zerion is designed for that next stage – when investors move funds on-chain and want to manage wallets, liquidity pools, and yield positions as part of a cohesive portfolio rather than just a scattered collection of tokens.

Role: DeFi-Oriented Tracking Focused on Wallet Performance

Zerion centers everything around the wallet address. Instead of relying on exchange APIs, it reads data directly from blockchains and DeFi protocols, building a unified, real-time view of on-chain activity. For long-term investors, this makes it easier to see how staking, farming, and liquidity positions contribute to portfolio growth over time.

A typical user connects one or more wallets and immediately sees token balances, pool shares, and protocol exposure. The dashboard highlights total portfolio value, daily price movements, and position-level details. While primarily geared toward active DeFi participants, it still gives long-term holders a clear sense of how rewards and compounding shape their overall growth.

Here’s a brief overview of Zerion’s approach:

| Aspect | Zerion Approach | Benefit for Long-Term Investors |

| Data source | Direct blockchain reads | Fewer errors from missing API connections |

| Portfolio anchor | Wallet addresses | Natural fit for DeFi-native users |

| Yield positions | Protocol-level breakdowns | Better visibility into compounding effects |

| NFT exposure | Included in portfolio view | Complete on-chain picture |

This structure suits investors who view their Ethereum or multi-chain wallets as long-term accounts rather than short-term trading tools.

Pros: Tracks Yields, DeFi Positions, and On-Chain Growth

For DeFi-focused portfolios, Zerion provides insights that traditional trackers often miss. It helps users see which protocols drive growth, how much value sits in liquidity pools, and how token performance and rewards interact to shape ROI.

Notable strengths for long-term use include:

- Protocol awareness – Zerion recognizes major DeFi platforms and labels positions correctly, so farming and staking data appear organized rather than random.

- Historical snapshots – users can look back at previous portfolio states to understand how market cycles affected their net worth.

- Cross-chain reach – supports multiple blockchains, revealing whether an investor’s funds drift toward one network or remain diversified over time.

For those who started yield farming in 2021, paused during 2022, and returned in 2024, Zerion offers a continuous historical view that tells the story of that journey through wallet data and protocol exposure.

Cons: Limited CEX Integration and No Long-Term Projection Modeling

Despite its DeFi strength, Zerion leaves gaps for users managing both centralized exchange (CEX) and on-chain assets. Since it focuses mainly on blockchain data, exchange balances must be tracked manually or through separate tools.

The limitations show up as:

- Partial portfolio coverage – large holdings on exchanges aren’t automatically integrated.

- No deep multi-year modeling – while Zerion shows historical performance, it lacks long-term projections or CAGR simulations.

- Tax and accounting gaps – the platform visualizes growth well but doesn’t produce audit-ready or tax-compliant reports.

Here’s a quick summary of how those constraints affect long-term investors:

| Need | Zerion’s Strength Level | Impact |

| Unified CEX + DeFi tracking | Limited | Requires multiple tools |

| Multi-year ROI & CAGR projections | Moderate | Investors must calculate externally |

| Tax-ready exports | Low | Needs separate accounting software |

Because of this, Zerion works best as a DeFi-focused companion tool, not as a complete portfolio solution. Long-term investors who split capital between exchanges and on-chain assets typically use it alongside another platform to form a complete financial picture.

5. Koinly

Koinly built its reputation as one of the most accurate crypto tax platforms – but many long-term investors now use it well beyond tax season. Its precision in tracking cost basis, realized gains, and historical PnL makes it an excellent tool for understanding true, multi-year performance, especially for users managing assets across several exchanges and wallets.

Strength: Tax-Accurate ROI and Cost-Basis Precision

Koinly tracks every taxable event – from simple swaps to staking rewards and liquidity pool entries – with remarkable detail. This meticulous approach gives its long-term ROI calculations consistency and credibility. Rather than relying on rough averages, Koinly reconstructs the full transaction timeline, matching every acquisition and disposal based on your chosen accounting rule (FIFO, LIFO, HIFO, etc.).

For long-term holders, this clarity removes much of the confusion around where profits really come from.

Here’s a simplified breakdown of Koinly’s precision:

| Component | Koinly’s Behavior | Impact for Long-Term Users |

| Cost basis | Supports FIFO, LIFO, HIFO, Spec ID | Enables flexible multi-year modeling |

| Staking & rewards | Treated as income, timestamped accurately | Clarifies tax-adjusted ROI |

| Realized/unrealized split | Automatic across all accounts | Shows what gains are actually locked in |

| Multi-exchange reconstruction | Strong | Keeps ROI consistent even when assets move |

For anyone seeking an audit-friendly, long-term view of performance, Koinly offers one of the cleanest data structures available.

Pros: Clear Historical Logic and Realized/Unrealized Clarity

Beyond its tax focus, Koinly gives users confidence in their portfolio’s historical accuracy. Long-term investors often face fragmented data from old exchanges, small “dust” transfers, or missing staking entries – issues that Koinly actively repairs.

Key strengths include:

- Event classification clarity – every transaction type (staking, swap, wrap, reward) is clearly labeled, reducing ambiguity.

- Cross-year continuity – even if the investor switches exchanges or wallets, Koinly merges data smoothly across years.

- Stable history – consistent valuations remain intact after re-syncing accounts.

One user who migrated from Binance to Kraken in 2021 and later added DeFi in 2022 found Koinly to be the only tool that accurately linked all transfers without leaving duplicates or orphaned entries – a testament to its data integrity.

Cons: Built for Accounting, Not Investment Modeling

Despite its unmatched accuracy, Koinly’s interface and design language reflect its tax roots, not an investor’s dashboard. It focuses heavily on realized events and cost-basis adjustments – great for compliance, but less intuitive for those seeking forward-looking insights.

Some of its practical drawbacks include:

- No dedicated long-term ROI projections – Koinly reports what happened, but not what could happen through compounding or DCA.

- No CAGR or growth modeling – users must calculate these metrics separately.

- Tax-centric visuals – charts emphasize categories like income and disposals, not portfolio growth or efficiency.

Here’s a concise summary:

| Component | Limitation | Effect on Long-Term Investors |

| ROI modeling | No CAGR dashboards | Harder to visualize compound performance |

| Forecasting | None | Requires external planning tools |

| Interface | Tax-oriented | Investment insights feel secondary |

In short, Koinly delivers unmatched accuracy but stops short of providing deep strategic investment analysis. Most investors pair it with another tracker for visualization and forward planning, using Koinly purely as the foundation for trustworthy data.

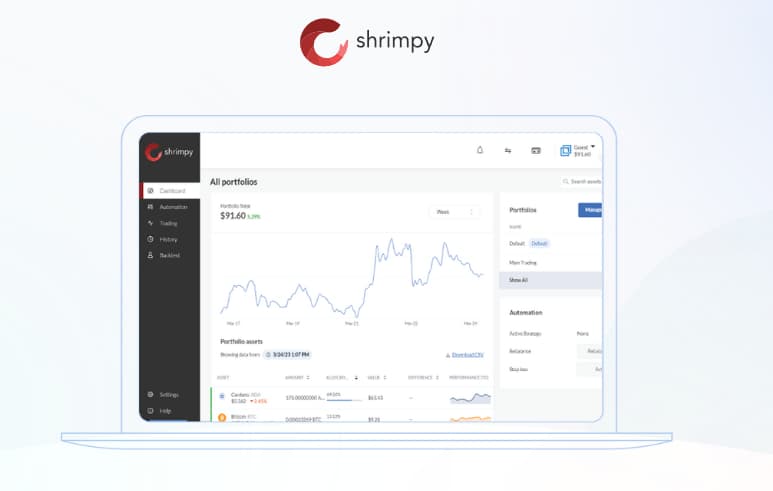

6. Shrimpy

Shrimpy caters to investors who prefer to automate large parts of their portfolio management. Instead of just tracking balances, it connects directly to exchanges, executes rebalancing strategies, and records the impact of those moves over time. For long-term investors who value a rules-based, systematic approach, Shrimpy functions as both a tracker and a lightweight automation hub.

Focus: Automation and the Effect of Periodic Rebalancing on ROI

At its core, Shrimpy operates on allocation rules. Users define a target portfolio structure – for example, 50% BTC, 30% ETH, 20% altcoins – and Shrimpy automatically rebalances to maintain that mix. Over several years, such strategies can generate a completely different return profile compared to a simple buy-and-hold, particularly in volatile markets.

The platform’s dashboard shows exactly how each rebalance affected performance. Trade logs, allocation charts, and timeline views make it easy to see when automation added value – or when it held returns back. Instead of treating rebalancing as a black box, Shrimpy exposes it as part of the long-term narrative.

Here’s a quick overview:

| Aspect | Shrimpy Approach | Long-Term Impact |

| Target allocation | User-defined percentages | Keeps the portfolio aligned with chosen strategy |

| Rebalance frequency | Time-based or threshold-based | Influences turnover and fees |

| Performance breakdown | ROI with and without rebalancing | Shows the real value of automation |

| Execution | Uses linked exchange accounts | Removes years of manual trade effort |

For systematic investors, this degree of control over structure and timing can be a major advantage.

Pros: Visualizing Compounding Through Active Rebalancing

Shrimpy helps users understand how compounding behaves when automation runs quietly in the background. Each rebalance shifts gains from outperforming assets into underperformers or stable positions – smoothing volatility or capping extremes depending on market behavior.

Its key strengths include:

- Scenario comparison – track automated vs. static portfolios side by side to see compounding effects clearly.

- Behavior transparency – every rebalance, trade, and timestamp is logged, leaving no hidden actions.

- Discipline support – automation helps investors avoid emotional, short-term decisions, supporting consistent long-term habits.

One long-term user described the experience this way:

“I stopped checking charts five times a day. My rules handle the rebalancing, and I just review monthly performance versus buy-and-hold.”

That statement captures how automation can help create long-term investing discipline.

Cons: Less Analytical Depth, Geared Toward Active Traders

Despite its strengths, Shrimpy isn’t a full-fledged analytics platform. Investors looking for deep, time-weighted return analysis, per-asset contribution insights, or tax-ready reports may find its reporting stops short. Shrimpy is designed more for what happened under this rule set than for exhaustive multi-year accounting.

Key trade-offs include:

- Limited focus on long-horizon metrics – CAGR views or decade-long ROI modeling are minimal.

- Trader bias – many presets cater to users who rebalance frequently or experiment with index-style baskets.

- External dependence for taxes and audits – investors often export data for more detailed accounting elsewhere.

Here’s a concise summary:

| Factor | Benefit for Shrimpy Users | Drawback for Long-Term Investors |

| Automation | Eliminates manual rebalancing workload | Reduces fine-grained control over trades |

| Reporting depth | Clear, rule-based performance summaries | Lacks advanced ROI metrics |

| Target audience | Systematic, rule-based investors | Less suitable for simple buy-and-hold strategies |

For long-term investors focused on precise multi-year analytics rather than automated execution, Shrimpy often serves best as a supporting tool rather than a main command center.

Summary

Understanding long-term crypto returns is far more complex than glancing at daily profit snapshots. Many investors spend their time watching short-term price changes-green and red flashes on screens-without realizing how those movements play out over multiple years. This section ties together the main insights from all the reviewed tools and explains how to manage multi-year performance with clarity instead of confusion.

How Most Tools Still Treat Returns as Static

Most portfolio trackers still focus on current value and percentage change from an entry price.

That’s fine for a single trade – one buy, one sell – but it breaks down once you introduce multiple deposits, withdrawals, and strategy shifts. When compounding, staking rewards, and rebalancing come into play, a simple “gain since purchase” view hides the real story.

Many dashboards display a single ROI figure based on current value minus total deposits. This shortcut ignores timing, inflows, and outflows, leading to false impressions of success or underperformance. Two investors can end up with the same final balance yet have very different real returns, depending on when and how they added capital.

Here’s a quick comparison of static vs. time-aware approaches:

| Scenario | Tracker Focus | Hidden Gap for User |

| Single lump-sum, no extra deposits | Simple ROI from entry vs. now | Minimal distortion unless rewards or fees are missing |

| Many buys over months | One blended entry price | Timing advantages or losses hidden |

| Ongoing DCA + staking rewards | Tracks balance change only | Fails to isolate reward-driven yield |

| Partial exits and re-entries | Net deposits vs. current value | True trading skill blurred by cash-flow timing |

Without time-aware logic, long-term performance often becomes guesswork disguised as analytics.

Why Clean Data and Consistent Methodology Matter

Reliable long-term metrics require two essential ingredients:

- Accurate, complete data, and

- A consistent calculation method that doesn’t change behind the scenes.

If even one data feed misses transactions or if a tool switches cost-basis rules midstream, multi-year ROI becomes noisy and misleading. That noise then influences future decisions about adding capital, rebalancing, or exiting assets.

A sound long-term analysis framework should include:

- A clearly defined cost-basis rule per asset

- Transparent handling of staking rewards, airdrops, and income

- Separate tracking of realized vs. unrealized gains

- Options for time-weighted and money-weighted returns

When these elements stay consistent, investors can compare performance between years, assets, or strategies with confidence. Without them, every comparison becomes apples to oranges.

Where CoinDataFlow Fits in This Landscape

Among the tools reviewed, each offers a piece of the long-term puzzle:

- CoinTracking provides tax-grade historical data.

- Zerion delivers DeFi context and wallet-based visibility.

- Koinly ensures accounting precision and clear cost-basis control.

- Bitwave brings institutional rigor for companies and audits.

Yet each comes with trade-offs – high complexity, narrow focus, or enterprise-level friction.

CoinDataFlow aims to sit comfortably in the middle. It offers transparent formulas, time-aware ROI, and CAGR modeling without burying users in accounting jargon or technical overload. Historical graphs, multi-asset comparisons, and long-horizon visualizations make it easier to see performance patterns across years, not days.

That balance – analytical depth with approachability – is what makes CoinDataFlow a practical tool for modern long-term investors. It bridges the gap between lightweight retail trackers and heavy institutional systems, delivering clarity without complexity.

FAQ

What’s the Most Accurate Way to Measure Long-Term Crypto ROI?

The most dependable way to measure long-term returns is to use time-aware metrics – specifically, time-weighted or money-weighted returns. These approaches account for when each deposit or withdrawal happens, not just how much was invested overall. By factoring in timing, they eliminate distortions that arise when you add funds during market dips or withdraw during rallies.However, even the best formula won’t help if the underlying data is incomplete. Accurate, fully recorded transaction histories are just as essential as the method itself.

Why Do Daily PnL and Yearly Returns Differ So Much?

Daily PnL reflects short-term volatility – it measures how your holdings changed in value since the previous day. Long-term ROI, on the other hand, tracks the entire journey of your invested capital: every buy, sell, reward, and reinvestment over time. This means that small daily fluctuations can build into large changes over years, while dramatic daily swings might barely move long-term ROI if most of your capital wasn’t exposed during that period.

Should Compounding and Staking Be Included in ROI?

Yes – but only when they’re measured correctly. Rewards and compounding change your cost basis and increase your position size, so they must be integrated into ROI calculations carefully. A proper return model distinguishes between price-driven gains and reward-driven growth, giving you a realistic picture of what’s actually generating profits.Tools that simply add staking rewards to “profit” without adjusting cost basis tend to inflate ROI artificially.

Are Free ROI Calculators Reliable for Multi-Year Holdings?

They work fine for simple, one-time investments but fall short once things get complicated. Free calculators rarely handle multiple deposits, partial exits, staking income, airdrops, or multi-chain activity.For long-term investors, those missing elements add up quickly, making results increasingly inaccurate over time.

Which Tools Visualize Historical ROI and CAGR Most Effectively?

The best tools combine clear visuals with methodological consistency. Look for features like ROI graphs over time, contribution timelines, and multi-asset performance comparisons. Platforms designed specifically for long-term investors – those that show CAGR calculations and maintain historical sync accuracy – tend to give the clearest, most meaningful results.

Why Do Yearly Returns Sometimes Look “Wrong” Even When the Math Is Correct?

Timing explains most of those discrepancies. If you invested most of your funds late in the year, after an asset had already risen, your personal return may look weak – even though the market itself had a strong year.Conversely, if you added funds just before a rally, your ROI might look exceptional compared to market averages. The math isn’t wrong; it’s simply showing the impact of cash-flow timing on your individual performance.